From Application to Authorization: Simplifying Your Car Financing Provider Trip

Browsing the process of obtaining auto funding can typically really feel like a maze of documents, credit scores checks, and waiting durations. By unwinding the complexities of this path, people can pave the way for a smoother and extra expedited experience in accomplishing their car financing goals.

Comprehending Vehicle Funding Options

When checking out auto funding choices, it is important to meticulously take into consideration the terms and conditions supplied by lenders to make a notified choice. A longer lending term may provide lower monthly repayments however could lead to paying more in interest over time. On the other hand, a shorter finance term might have higher regular monthly settlements but can conserve you cash on passion.

Additionally, comprehending the deposit demands is important. A higher down settlement can decrease the quantity funded, potentially lowering month-to-month settlements and total passion expenses. On the other hand, a reduced down payment may lead to greater monthly settlements and increased passion expenses. Evaluating these aspects adequately will assist you select the automobile financing option that lines up best with your financial objectives and conditions.

Celebration Required Paperwork

To speed up the automobile funding process, assembling the necessary documents immediately is important for a smooth and effective experience. It is also advisable to ascertain the demands with your loan provider or financing institution to guarantee you have all the required documentation. By proactively collecting and submitting the called for documentation, you can quicken the authorization process and relocate more detailed to protecting the vehicle funding you need.

Optimizing Credit History

Enhancing your credit report is a key variable in safeguarding favorable terms for your automobile funding solutions. A greater credit rating not just increases your opportunities of lending approval however also plays a substantial duty in determining the rate of interest you will certainly be used. To maximize your credit report, beginning by getting a duplicate of your credit report from major credit score bureaus. Testimonial the record very carefully for any type of errors or inconsistencies that might be negatively impacting your score. Guarantee that all info is precise and as much as date.

If you have a minimal credit background, think about becoming a licensed customer on a family members participant's credit report card to build credit report. By taking these steps to enhance your debt rating, you can boost your chances of securing desirable terms and a smooth automobile funding solutions trip.

Checking Out Online Application Systems

In today's electronic age, the usage of on-line application systems has actually reinvented the process of applying for auto funding services. These platforms provide convenience, performance, and ease of access to people looking for cars and truck loans. By merely filling up out see it here on the check out this site internet forms and submitting essential papers electronically, applicants can start the financing process from the comfort of their very own homes. On the internet applications additionally make it possible for lending institutions to quickly examine and process the details provided, quickening the approval timeline. Furthermore, candidates can conveniently compare various funding alternatives, rate of interest, and terms from numerous loan providers on these platforms, equipping them to make educated decisions. The seamless nature of online applications minimizes the demand for physical documents, saving time and resources for both candidates and lenders. Furthermore, the digital nature of these platforms makes sure data safety and personal privacy, giving applicants comfort when sharing delicate monetary information. Generally, exploring on the internet application systems has actually substantially streamlined and improved the cars and truck financing solutions trip for customers.

Browsing the Authorization Refine

During the approval procedure, it is important to react promptly to any demands for additional information or documentation from the lending institution. Delays in providing the needed details can prolong the authorization timeline. Furthermore, maintaining open interaction with the lending institution can aid attend to any problems or inquiries they might have regarding your application.

After the loan provider completes their evaluation, they will certainly figure out whether to approve your cars and truck financing demand. If approved, you will certainly receive the terms of the lending arrangement, including rate of interest prices, regular monthly settlements, and any added costs. It is critical to review these terms very carefully prior to accepting the deal to guarantee they line up with your economic goals and abilities. By proactively joining the approval procedure and remaining informed, you can improve your auto financing journey browse this site and protect an ideal financing for your car acquisition.

Conclusion

To conclude, enhancing the cars and truck funding solutions trip involves understanding funding options, collecting necessary documents, maximizing credit rating, discovering on-line application systems, and navigating the approval procedure. By adhering to these actions, individuals can make the procedure a lot more efficient and boost their possibilities of getting authorized for auto funding (Chevy service center). It is necessary to be well-prepared and notified throughout the entire process to guarantee a smooth experience

Jennifer Grey Then & Now!

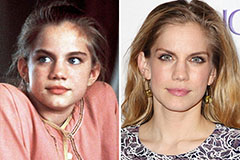

Jennifer Grey Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now!